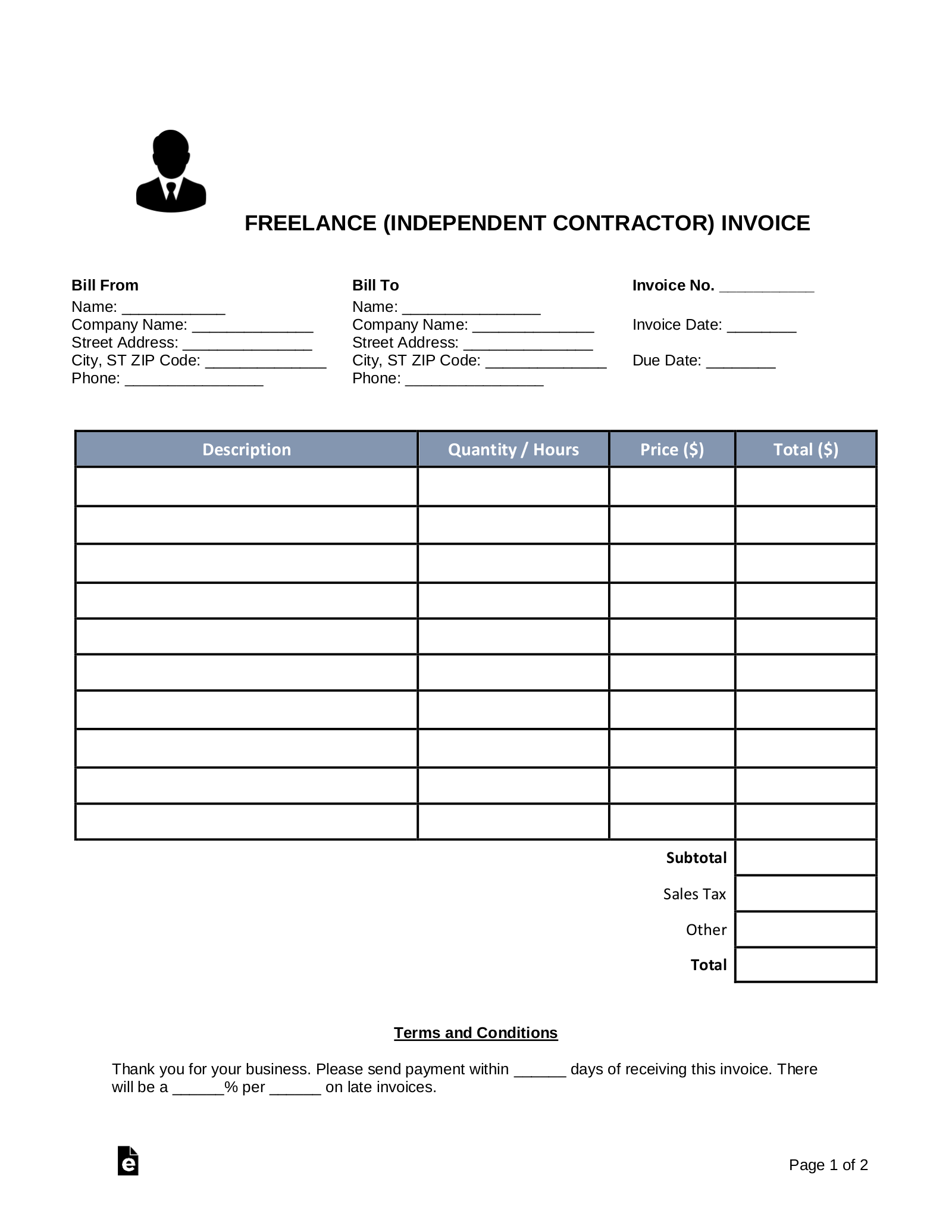

When you`re done, click Preview to see what your invoice will look like for your customer. You can add custom notes, terms and conditions, discounts, or attachments that your customer might need. Then add an item with its quantity and quantity.Īdd as many items as you want. Simply enter your customer`s email address. When deciding when to send an invoice, it`s best to find the best process for you and your customers. You can send your invoices by post or email directly to your customers. Others may require a deposit in advance or accept additional payments. Many self-employed workers charge their clients before goods or services are delivered, and some follow suit. Send your self-employed bill on the way to get paid in no time. If there are conditions, list them as well. Unlike an employee, a person who is self-employed is responsible for paying their own depreciation of all mandates so that there is no confusion. The self-employed invoice template is intended for any type of work, service or advice performed on behalf of another person. For example, they may charge a certain hourly rate, as well as a separate fee for materials needed to provide the service.Īs a general rule, you should be as clear and detailed as possible when creating your invoice. A model invoice for an independent contractor providing multiple services may include a breakdown of their loading process. For all contract work, your individual terms must be included on your invoice in addition to your general rates. Independent contractors should file their tax returns quarterly. The hardest part is being disciplined enough to save and allocate funds to pay taxes when the time comes. Filing tax returns as an independent contractor is as simple as filing IRS Form 1099 (whereas an employee would file IRS Form W-2). By making sure you declare a position for all applicable taxes, you protect yourself from a deduction from your income that is too low and not being able to pay your federal, state, and municipal taxes. It`s important to remember that at the end of each year, when you fill out a Form 1099, you`re responsible for paying those taxes to the IRS. As an independent contractor, your taxes are not automatically deducted by your employer to meet federal, state, and municipal tax requirements. We have created all kinds of invoice templates to meet the individual needs of your business.

#INVOICE FOR INDEPENDENT CONTRACTOR TEMPLATE DOWNLOAD#

Just download the template below, fill it out and submit it. FreshBooks` freelance model calculation model clearly presents your modeling sessions and billing information in a perfectly designed format that will impress your clients and advance your career. Your invoice reflects your style and reputation and plays a role in getting your future role as a model. The FreshBooks Freelance invoice template is perfect for models who want to advance their career and stand out in the modeling profession. If you`re a role model, you know how important presentation is. Get the mobile app from the Apple Store or Google Play. With the PayPal Business mobile app, you can send and manage invoices on the go.

You can create, send, and manage invoices on desktops and mobile phones.

0 kommentar(er)

0 kommentar(er)